Leverage

AUTO APPRAISALS

TOTAL LOSS APPRAISALS

Automotive Insurance Total Loss Appraisals and Negotiation by an Oregon Licensed and Certified Total Loss Appraiser.

OVER 150 LOCAL 5 STAR GOOGLE REVIEWS!

click here to see our REVIEWS

NOW SERVING WASHINGTON STATE ALSO!

Is your insurance company Offering an unfair offer that is less than what your totaled vehicle is worth?

We can help! You need a professional on your side that doesn’t work for the insurance companies. You deserve a fair settlement and hiring a Total Loss Auto Appraiser who specializes in Oregon total loss claims is your first step to receiving a Fair Total Loss Settlement.

We Don’t take a percentage and Oregon law guarantees you 100% Reimbursement for the appraisal if we increase the value over your insurance company’s last offer by just 1 cent.

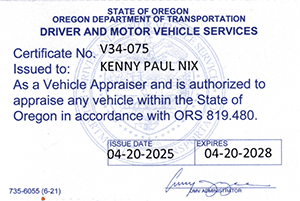

Oregon Certified Vehicle Appraiser #V34-075 • We provide car appraisals for Totaled vehicle Insurance claims, Total Loss Appraisal Clause Disputes, Total Loss Appraisals and negotiation for stolen totaled Trucks and Cars, and other totaled vehicle appraisals. We can help with Flood damage, Tree Damage, Wind Damage, Mud Slide damage, Deer, Elk, and just about anything that is claimed under your insurance policy.

Recently, many CCC ONE, Mitchell and JD Powers valuations have been coming in as little as 30 percent of the true market value for many Diesel Trucks with the 7.3, Duramax or Cummins engines. That’s what the appraisal clause in your policy is for. It allows you to dispute their lowball valuations.

Call us now for a free Claim Review: 503.420.3001

What is an Appraisal Clause?

An appraisal clause is a contractual process in your auto insurance policy used to settle disputes between insurers and their policyholders when the parties fail to agree on the amount that will be covered by the policy.

If your insurer refuses to provide a fair settlement amount on your vehicle’s loss, you have the option to resolve the issue by going through your insurance policy’s appraisal clause. This prevents insurance companies from taking advantage of you.

If you do not agree on the amount of the loss, you may demand (invoke) an appraisal. In this scenario, each party will choose an independent auto appraiser. In many cases, even their auto appraiser will be higher than the last offer your insurance company made to you. The appraisers will negotiate the value and come to an agreement, or have an umpire make a decision between the two appraisals. I’ve been doing this for 15 years, and have only had 6 times where we had to go to an Umpire. .

The key to a successful appraisal clause dispute is finding an expert who has the necessary vehicle knowledge and negotiation skills to handle the various aspects of the process. This includes choosing an umpire and negotiating with the other parties involved. Our Oregon Licensed Auto Appraiser, Ken Nix, has been negotiating Oregon Total Loss disputes for around 15 years in Oregon. He’s local, only works for consumers, and isn’t indebted to the insurance companies like many appraisers who rely on them for income. We receive no compensation in anyway from any insurance companies.

Let me make this clear

I work for policyholders, and only policyholders. I DO NOT WORK FOR or RECEIVE any COMPENSATION from ANY INSURANCE COMPANY.

When someone receives tens of thousands of dollars in recurring business from a single source, such as an insurance company, it is easy to say they are unbiased. Most people genuinely believe they are fair.

The harder question is this. How would they know if they are not?

Subconscious bias does not announce itself. It does not feel unethical. It feels reasonable. It shows up in small decisions, in benefit of the doubt judgments, in how aggressively someone challenges a weak comparable, or whether they push for one more round of negotiation or decide the number is close enough.

When future assignments, steady volume, and significant income come from the very companies on the other side of the table, there is built in pressure to maintain that relationship. No one has to say it out loud. It simply exists.

That is why independence is not just a marketing phrase. It is a structural reality. If your appraiser depends financially on insurance companies, the question is not whether they claim to be unbiased. The question is whether true objectivity is even possible under that model.

Most auto appraisers who accept insurance company assignments charge the carrier a lot more than I charge a consumer. On average, their fee is often higher, yet their workload is far more streamlined. They can manage two to three times as many files per month because their role is limited. They only report to the adjuster, who seldom asks questions. They are not fielding dozens of calls a day from concerned vehicle owners. They are not walking clients through rental fees, storage fees, reimbursement questions, or negotiation strategy. They are not challenging the very company that hires them.

Their client is the insurance company.

When an appraiser depends on carrier relationships for steady work, there is an unspoken reality. Maintaining that relationship matters. Volume matters. Efficiency matters. Keeping the assignment pipeline open matters. Keeping them happy with LOWER PAYOUTS MATTER!

When you hire me, none of that applies.

I do not answer to an insurance carrier. I do not rely on them for referrals. I do not need to keep them satisfied to secure future work. My responsibility is to the policyholder, period. That means more research, more documentation, more negotiation, and often more resistance. It also means fewer total cases at one time, because each one requires significantly more attention and advocacy.

If someone wants frequent check ins, constant reassurance and updates, someone working for an insurance company may be your better choice. There are plenty of professionals who do 80% of their business with insurance companies and 20% with consumers to keep up appearances as if they are consumer friendly. But it is important to understand who their real customer is.

If you hire an appraiser who regularly works for insurance companies, the insurance company is not just a third party in the process. It is part of their business model.

I chose a different model.

I represent vehicle owners. Not carriers. Not adjusters. Not corporate claim departments.

That difference is not small. It is everything.

A few recent Settlements:

- Springfield, Oregon. – Increase: $17,757 – 52% increase – State Farm – Michael L. – 2015 Lance Toy Hauler

- Portland, Oregon – Increase: $32,917 – 27% Increase – State Farm – E. Doughtie, Portland, OR. 2022 Mercedes Benz Sprinter Off Grid Van

- Rogue River, Oregon – Increase: $13,207 – 18% Increase – Progressive – A. Thakur 2023 Tesla Model X

- St. Helens, Oregon – Increase: $2,360 – 28% increase – Travelers – 2011 Toyota RAV4

- The Dalles, Oregon – Increase: $11.647 – 50% increase – State Farm – J. Brennan 2016 Mercedes-Benz Sprinter Cargo 2500

- Estacada, Oregon – Increase: $5,177 – 118% Increase – Progressive – T. Harrington 2002 Subaru WRX

- Brush Prarie, Washington – Increase: $9,169 – 58% Increase – American Family – J. Meracle – 2006 Dodge Ram 3500 Laramie Mega Cab Diesel

- Portland, Oregon – Increase: $10,426 – 329% Increase – State Farm – R. Estrada – 1990 Harley Davideson FLHS Electic Glide

- Hillsboro, Oregon – Increase: $6,590 – 34% Increase – USAA – R. McCarthy – 2008 Dodge Ram 3500 Diesel

Watch our Videos to better understand the Appraisal Clause Process

What Clients Are Saying About Leverage Auto Appraisals

See all of our Reviews Here: Leverage Auto Appraisals REVIEWS

WHY CALL THE BUSINESS LEVERAGE AUTO APPRAISALS?

Our name sorta pays homage to a TV series that ran from 2008 to 2012. It was about a group of unsavory characters that banded together to form a team to help the underdogs. Their tagline was “The rich and powerful take what they want, we steal it back for you. Of course, we don’t steal anything. We do negotiate for average people against companies that are worth up to 700 BIllion Dollars. We feel the little guy should be represented by a well rounded appraiser. The show was actually filmed here in Portland, Oregon. Although, for the first 4 seasons, it was fictionally based in Boston. The “crew” was composed of a Mastermind, Hacker, Thief, Grifter, and Hitter”. Although I’m not a team, I do bring some diverse traits to the table. To get a little taste of the Leverage TV Show, here’s a link to a the Leverage Intro on Youtube: https://www.youtube.com/watch?v=NsHQjVMtjrA

YOu can also catch both the old Leverage TV series on Prime TV or the new Leverage Redemption series also on Prime TV.

So, I have a client that went above and beyond just writing a review. He basically made me a video review that I could use as a commercial. Thank you Shawn. This is so AWESOME!

WHO IS KEN NIX

- Ken Nix is a local Oregon Certified and Licensed Vehicle appraiser who has been authorized by ODOT to appraise vehicles in Oregon for over 15 years.

- Ken started in the automotive industry in the 1980s and has sold and appraised tens of thousands of vehicles including late model cars and trucks, Exotics, Muscle Cars, Street Rods, Vintage, Classics, Street Rods, Camper Conversions, and even Japanese right-hand drive vans while working for multiple franchises over 20 years. Ken is the independent appraiser chosen by Ron Tonkin Gran Turismo for independent vehicle assessments.

- Previously employed by Diversiform and Reynolds and Reynolds. Ken worked for years with local Automotive Dealers to market vehicles. Hundreds of Dealership owners, managers, and staff know and trust him. Ken also worked with Lanphere Enterprises, and many other local dealers to provide digital solutions for automotive marketing.

- Ken is the founder of Volkswagen Owners Club, My GTI, and Jetta Junkie and was an Administrator for Autoguide.com for over 10 years.

- Ken’s wife jokes that sometimes she’s married to Liam Neeson because Ken has a very particular set of skills, skills he’s acquired over a very long career.

- Ken has actual long term automotive sales, appraisal and negotiation experience. Beware long term businesses with inexperienced vehicle appraisers claiming decades of experience because a relative founded the business. Make sure your automotive appraiser has the real world experience to back up their claims.

- Ken’s background in training salespeople on Product Knowledge, combined with auto body repair assessment experience and his computer background provides negotiating leverage over opposing appraisers. The ability to spot bad repairs from prior damage on an opposing appraiser’s comparables to discrediting salt state and flood damaged vehicles used by your insurance company’s valuations from CCC One and Mitchell / J.D. Powers to lowball your vehicle.

- Expert Negotiator. Personally trained one on one by Zig Ziglar, Tom Stuker, and Grant Cordone. Over 45 years experience as a professional negotiator.

- Ken’s Automotive, Computer Technology, Legal Reseach, and Negotiating background provides a very specific skill set that makes him a nightmare to opposing appraisers.

Recent Total Loss Appraisal Clause Claim Settlements

2005 GMC 3500 SLT

- Insurance Company: Progressive

- Settlement Increase: $6297.07

- Percentage Increase: 37%

- Portland, Oregon

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $17,202.93

- Settlement: $23,500.00

- Client: Cody B.

- Final Cost to client for our services after reimbursement from their insurance company: $0.00

2002 Toyota Sequoia Limited

- Insurance Company: Geico

- Settlement Increase: $4,320

- Percentage Increase: 84%

- Hillsboro, Oregon

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $5,180.00

- Settlement: $9,500.00

- Client: Nathaniel M.

- Final Cost to client for our services after reimbursement from their insurance company: $0.00

2004 Porsche Cayenne Turbo

- Insurance Company: Progessive

- Settlement Increase: $7,971

- Percentage Increase: 77%

- Portland, Oregon

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $10,428.68

- Settlement: $18,400.00

- Client: Alexandre B.

- Final Cost to client for our services after reimbursement from their insurance company: $0.00

2018 Hyundai Elantra

- Insurance Company: Geico

- Settlement Increase: $1,714.00

- Percentage Increase: 12%

- Portland, Oregon

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $14,786.00

- Settlement: $16,500.00

- Client: Sadie B.

- Final Cost to client for our services after reimbursement from their insurance company: $0.00

2014 Jaguar XJ

- Insurance Company: Allstate

- Settlement Increase: $4093.00

- Percentage Increase: 19%

- Portland, Oregon

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $5,180.00

- Settlement: $9,500.00

- Client: Kenneth P.

- Final Cost to client for our services after reimbursement from their insurance company: $0.00

1971 Ford Bronco

- Insurance Company: USAA

- Settlement Increase: $8,742.00

- Percentage Increase: 14%

- Klamath Falls, Oregon

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $63,258

- Settlement: $72,000.00

- Client: Thomas H.

- Final Cost to client for our services after reimbursement from their insurance company: $0.00

2005 Dodge Neon SRT-4

- Insurance Company: Progressive

- Settlement Increase: $8,083.00

- Percentage Increase: 178%

- Yakima, Washington

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $4,543.00

- Settlement: $12,626.00

- Client: Alex, C.

- Final Cost to client for our services (Washington Does Not have a law that demands reimbursement, but his tax reimbursement increase was approximately $711.30, which was more than the cost of the appraisal): $499.00

2007 Toyota Prius

- Insurance Company: Progressive

- Settlement Increase: $5,550.00

- Percentage Increase: 75%

- Portland, Oregon

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $7,449.95

- Settlement: $13,000.00

- Client: Grant M.

- Final Cost to client for our services after reimbursement from their insurance company: $0.00

1999 Honda Civic DX

- Insurance Company: Progressive

- Settlement Increase: $3,529.09.00

- Percentage Increase: 180%

- Vancouver, WA

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $1,970.91

- Settlement: $5,500

- Client: Matt S.

- Final Cost to client for our services after reimbursement from their insurance company: $499 (Washington Does not have a law that demands reimbursement like Oregon does. But, the client also received an additional $310.00 in taxes. So his net increase was $3,340.00)

2012 Toyota Prius V Five

- Insurance Company: State Farm

- Settlement Increase: $8,044.33

- Percentage Increase: 63%

- Vancouver, Washington

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $12,784.00 CCC ONE

- Settlement: $20,828.33

- Client: Jeffery H.

- Final Cost to client for our services (Washington Does Not have a law that guarantees reimbursement, but his tax reimbursement increase was approximately $707.90, which alone was more than the cost of the appraisal): $499.00

1981 Chevrolet C10 Pickup

- Insurance Company: Progressive

- Settlement Increase: $7,028.67

- Percentage Increase: 72%

- Vancouver, Washington

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $9,800.00 Mitchell – JD Powers Valuation

- Settlement: $16,828.67

- Client: Jeffery H.

- Final Cost to client for our services (Washington Does Not have a law that guarantees reimbursement, but his tax reimbursement increase was approximately $618.52, which alone was more than the cost of the appraisal): $499.00

2001 Ford F250 SD

- Insurance Company: Progressive

- Settlement Increase: $9,581.69

- Percentage Increase: 98%

- Creswell, Oregon

Details

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $1,970.91

- Settlement: $5,500

- Client: Matt S.

- Final Cost to client for our services after reimbursement from their insurance company: $499 (Washington Does not have a law that demands reimbursement like Oregon does. But, the client also received an additional $310.00 in taxes. So his net increase was $3,340.00)

How To Video on The Appraisal Clause

Recent Total Loss Claims

2005 Dodge Ram 3500 SLT

Settlement Increase: $5,750.00

Details

-

Total Loss Dispute Appraisal and negotiation.

-

Insurance Offer: $18,750.00

-

Settlement: $24,500.00

-

Increase of: $5,750.00

2020 Ford F-550

Settlement Increase: $25,624.15

Details

- Total Loss Dispute Truck Appraisal Clause Negotiation.

- Insurance Offer: $54,370.85

- Settlement: $79,995.00

- Increase of: $25,624.15

2017 Nissan Sentra "Stolen Vehicle"

Settlement Increase: $4,746.00

Details

-

Total Loss Dispute Appraisal and negotiation.

-

Insurance Offer: $18,750.00

-

Settlement: $24,500.00

-

Increase of: $5,750.00

2019 Ford Ranger Lariat SuperCrew

Settlement Increase: $2,573.00

Details

- Insurance company: National General Insurance

- Initial Valuation: CCC One Market Valuation Report

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $40,427.00

- Settlement: $43,0500.00

- Increase of: $2,573.00

Mitsubishi EVO

Settlement Increase: $9,417.00

Details

- Farmers Insurance Total Loss Appraisal clause dispute

- CCC One Valuation

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $18,833.00

- Settlement: $28,250.00

- Increase of: $9,417.00

2020 GMC Yukon SLT 4WD

Settlement Increase: $10,286.00

Details

- Progressive Insurance Total Loss Dispute

- Mitchel / J.D. Powers Valuation

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $50,214.00

- Settlement: $60,500.00

- Increase of: $10,286.00

LEVERAGE

Auto Appraisals | Total Loss Appraiser

(503) 420-3001

Location

1222 SE 85TH AVE

Portland, OR. 97216

Open Hours

Mon:10am – 5pm

Tue: 10am – 5pm

Wed: 10am – 5pm

Thur: 10am – 5pm

Fri: 10am – 5pm

Sat: 10am – 5pm

Sun: Closed