Auto Appraiser: Key Responsibilities and Qualifications of a Total Loss Appraiser

What is an Auto Appraiser?

An auto appraiser is a professional who assesses a vehicle and determines its market value. They may work for either the insurance company or the policyholder and are responsible for ensuring that the insurance company pays a fair amount for the vehicle in the event of a Total Loss. Auto appraisers play a crucial role in the insurance industry by determining the value of a vehicle that has been in an accident.

Key Responsibilities of a Total Loss Appraiser

A total loss appraiser is responsible for determining the market value of a vehicle just before a loss happened. This means assessing other vehicles similar to the loss vehicle and comparing them to the vehicle to determine the value. In Oregon, if the cost of repairs is more than 80% of the value of the vehicle, it is considered a total loss. In addition, the appraiser is responsible for:

- Preparing an appraisal.

- Inspecting the subject vehicle if needed.

- Negotiating with the opposing appraiser to determine the true market value.

Qualifications of an Oregon Licensed Auto Appraiser

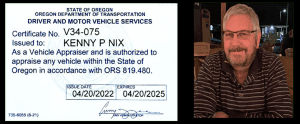

In order to become an Oregon licensed auto appraiser, there are certain qualifications and requirements that must be met. Our appraiser, Ken Nix, has met all of these qualifications and has been licensed and certified by the Oregon Department of Transportation to appraise vehicles in Oregon for over 13 years.

In addition to these requirements, it is important for auto appraisers to have strong communication and negotiation skills, as well as knowledge of the automotive industry and the ability to assess damage accurately.

What to Look for in an Oregon Auto Appraiser

When searching for an Oregon auto appraiser, there are a few key things to look for to ensure that you are working with a qualified and experienced professional. These include:

– Proof of licensing and certification

– Experience in the automotive industry

– Strong communication and negotiation skills

– Knowledge of the auto repair industry

– Accurate assessment of damage and cost of repairs

Auto appraisers play a crucial role in the insurance industry by determining the value of a vehicle that has been in an accident. Total loss appraisers, in particular, are responsible for determining the value of a totaled vehicle before it was totaled. When searching for an Oregon auto appraiser, it is important to look for experience, communication skills, knowledge of the industry, and accuracy in assessing damage and cost of repairs.

Case Studies Illustrating Effectiveness Of Appraisal Clause In Oregon

-Progressive 2005 GMC 3500 SLT

Portland, Oregon

MITCHELL VALUE: $ 17,202.93

Mitchell: $10,428.68

What do you do if you disagree with your insurance company on the value of your vehicle?

You do not have to accept your insurer’s lowball offer.

If you think your insurance company is offering a lower value for your vehicle than what it’s actually worth, you don’t have to accept their offer. You can continue negotiations directly with the adjuster or if you have full coverage in Oregon and your policy includes an appraisal provision, consider hiring Leverage Auto Appraisals. They are a local Oregon-based auto appraisal company with a licensed and certified ODOT appraiser who can assess and negotiate the total loss claim with your insurer.

According to Oregon Law. The appraisal costs must be reimbursed by your insurer if the final appraised value exceeds their last offer. Leverage Auto Appraisals is a local Oregon-based auto appraisal company with a licensed Oregon auto appraiser certified by the Oregon Department of Transportation (ODOT) who will assess and negotiate the total loss claim with your insurance company.

At Leverage Auto Appraisals, we focus solely on consumers in Oregon and Washington. We have no affiliation with any insurance company and are committed to always providing objective and unbiased assessments of your vehicle’s value, then negotiating with your insurance company to obtain the real fair market value you should be paid.

Over 99 percent of our client’s services have been free on 1st policy total loss claims in Oregon for the past 13+ years. Leverage provides credible appraisals to Oregon policyholders for total loss and we also negotiate your claim free of charge on all first-party claims. (with your own insurance company).

You need LEVERAGE

We provide credible total loss appraisals and Expert Negotiation to help you get a fair settlement on your totaled or stolen car or truck.

OREGON Certified/Licensed Auto Appraiser # V34-075

Vehicles we specialize in:

Acura, Audi, Bentley, BMW, Buick, Cadillac, Chevrolet, Chrysler, Corvette, Dodge, Ferrari, Fiat, Ford, Freightliner, GMC, Honda, Hummer, Hyundai, Infiniti, International, Isuzu, Jaguar, Jeep, Kia, Lamborghini, Land Rover, Lexus, Lincoln, Maserati, Mazda, Mercedes-Benz, Mercury, Mini-Cooper, Mitsubishi, Oldsmobile, Peterbilt, Plymouth, Pontiac, Porsche, Rolls Royce, Saab, Saturn, Scion, Shelby, Subaru, Tesla, Toyota, Volkswagen, Volvo.

RV’s – American Coach, Coachmen RV, Entegra Coach, Fleetwood RV, Forest River RV, Holiday Rambler, Jayco, Monaco Coach, Newmar, Nexus RV, Thor Motor Coach, Tiffin, Winnebago

Trucks, Stolen F-350, F-250, F-250, Diesel trucks, 7.3, Duramax, Cummins, Sprinter Vans, Camper Vans, and more.

Oregon Total Loss Services:

| Aloha Oregon Total Loss | Albany Oregon Total Loss | Beaverton Oregon Total Loss | Bend Oregon Total Loss |

| Corvallis Oregon Total Loss | Eugene Oregon Total Loss | Grants Pass Oregon Total Loss | Gresham Oregon Total Loss |

| Hillsboro Oregon Total Loss | Keizer Oregon Total Loss | Lake Oswego Oregon Total Loss | MCMinnville Oregon Total Loss |

| Medford Oregon Total Loss | Newberg Oregon Total Loss | North Bend/Coos Bay Oregon Total Loss | Oregon City Oregon Total Loss |

| Portland Oregon Total Loss | Redmond Oregon Total Loss | Salem Oregon Total Loss | Springfield Oregon Total Loss |

| Tigard Oregon Total Loss | Tualatin Oregon Total Loss | West Linn Oregon Total Loss | Wilsonville Oregon Total Loss |

Total Loss, Getting Your Real Market Value.

We don’t just write a Total Loss Fair Market Value appraisal like some companies. Our Total Loss auto appraiser will also negotiate with your insurance company’s appraiser to get a fair value for your totaled vehicle. This is included in the price of your appraisal, you won’t be upsold later on like some companies. Ken has over 38 years of negotiation experience. Licensed Auto Appraiser in Oregon

Auto Appraiser

Over 11 years as an Oregon Licensed Auto Appraiser

Negotiator

Over 38 years experience in negotiations.

Only Works For Consumers

No conflict of interest here. We only work for consumers, not insurance companies.

Detailed Specs

In Oregon and Washington, if you feel you’ve been offered an unfair amount, you’ll normally have an appraisal clause in your policy that allows you to dispute their offer. The appraisal clause allows you to hire an independent auto appraiser to produce an appraisal and your insurance company will also have to hire an independent auto appraiser to produce one for them. The two auto appraisers will negotiate the value between them, if they can not come to an agreement, then an Umpire will decide which appraisal is more credible.

In Oregon, if we increase the value by one cent more than the last offer your insurance company offered you, they have to reimburse you for the cost of the appraisal.

If your claim is with your insurer, you may have the right to an appraisal if your policy

includes an appraisal provision. Your insurer must reimburse your reasonable

appraisal costs if the final appraised value is greater than the insurer’s last offer. This

provision applies to all new policyholders on or after January 1, 2010 and to current

policyholders upon the first renewal of their policy that occurs on or after January 1,

2010. Ask your claims adjuster or the Insurance Division for more information.

Lowball offers from CCC One are more common than you may think. In the case of Buratovich v. Farmers Insurance, documents obtained during discovery, reflected that Farmers Insurance had selected CCC One solely due to it’s evaluations having the lowest payout in regards to a Total Loss Claim. CCC has also recently come under fire in Georgia where consumer advocates claim they have substantially lower valuations than other companies.If your car, truck, RV, motorcycle, or other wheeled vehicle has been totaled, before you accept the insurance company’s total loss offer, you should speak to an Auto Appraiser.

There have also been several Class Action Lawsuits filed regarding Mitchell / J. D. Powers and Associates Total Loss Valuation Methods. This valuation has been involved in several cases where consumers have sought class action lawsuits against State Farm and Progressive for using Mitchell and J.D. Powers valuations.

Oregon Law requires the automobile insurance companies to:

- Provide written notice to the vehicle owner explaining total loss. The notice should inform Oregon claimants, how car valuations are determined, and what steps an owner can take if they disagree with the insurer’s offer.

- Provide the Oregon car owner the appraisal or valuation reports that have been used to determine the value of the damaged vehicle.

- Pay the total loss owner the amount that isn’t in dispute, while the negotiation over the car valuation continues. (For example, if the insurer offers $15,000 and the vehicle owner seeks $18,000, the insurer should pay the $15,000 immediately).

- Reimburse the car owner for reasonable car appraisal costs. This will apply when the car owner has a right to seek appraisal and the final appraised value is higher than the last offer of the insurer.

CALL NOW FOR A FREE CLAIM REVIEW!

503.420.3001

OREGON CERTIFIED AUTO APPRAISER

OREGON CERTIFIED APPRAISER

When Hiring an Auto Appraiser, make sure they are certified by the Oregon Department of Transportation. Otherwise, the appraisal may not be considered credible. We are an Oregon certified and licensed auto appraiser. #V34-075

CREDIBLE APPRAISALS

Some appraisal companies inflate their valuations in an effort to entice you to use them because they have the largest value. Largest doesn’t mean you’ll settle for more, normally it’s the opposite. Most insurance companies know who provides credible appraisals, and who provide inflated values

AUTOMOTIVE EXPERIENCE

With over 11 years as a licensed and Certified Oregon Auto Appraiser, Ken has the experience to handle any job. He has over 38 years negotiating experience with over 30 years spent in the automotive industry.

You DESERVE A FAIR SETTLEMENT

LEVERAGE

Auto Appraisals

(503) 420-3001

Location

8885 SW Canyon Rd.

Portland, OR. 97225

Open Hours

Mon:10am – 5pm

Tue: 10am – 5pm

Wed: 10am – 5pm

Thur: 10am – 5pm

Fri: 10am – 5pm

Sat: 10am – 5pm

Sun: Closed