If you have been in an auto accident and your car has been deemed a Total Loss, you may be entitled to a Total Loss Appraisal settlement. This settlement is based on the appraisal clause in your insurance policy which states that the insurance company must pay for the full value of your vehicle or its replacement cost (whichever is higher). To ensure that you receive the highest Total Loss Appraisal settlement possible, there are several steps you can take.

1. Determine If You Have An Oregon Total Loss Claim.

First, it is important to understand exactly what a Total Loss claim means so that you can make an informed decision about how to proceed with your claim. A Total Loss Appraisal is a process by which an appraiser determines the value of a totaled vehicle before the loss and the insurance company is required to pay the policyholder what the vehicle was worth before the loss.

Once you understand you have a Total Loss claim, it is important to determine which of your coverage options applies in your particular situation. In most states, Total Loss coverage is required by law for 3rd party at-fault auto insurance policies, this is known as liability insurance. But, it is possible that you may have purchased additional coverage for your own vehicle. If this is the case, check with your insurer about any special requirements or limitations that may apply before submitting your claim.

2. FREE CLAIM REVIEW

It’s also a good idea to collect as much information as possible about your vehicle prior to submitting your Total Loss Appraisal claim. Be sure to include all documents related to the vehicle’s purchase and ownership, such as bills of sale, service records, and any other relevant paperwork.

Request a Free Total Loss Claim Review to find out how much your vehicle is really worth. Instructions are further down on the page below. Once we received the valuation, Ken will review it and let you know what the value should be and his opinion on what he thinks we can settle the claim for.

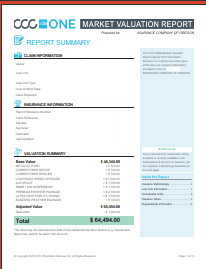

Request a PDF of the evaluation. Normally this will be a CCC ONE, Mitchell, JD Powers, or Audatex valuation report from your insurance company. Email it with your name in the Subject Line to us at:

3. ORDER APPRAISAL

If everything looks like you have a claim and you want to proceed, we’ll send you an invoice so you can move forward. Ken Nix will personally prepare and negotiate your claim with your insurance company.

Be aware some appraisal firms may provide a lower cost for an appraisal only and bill the negotiation separately. We include negotiating your claim at not additional charge when you purchase an appraisal for an appraisal clause with us. Under Oregon law, your insurance company is required to reimburse you for the cost of the appraisal if we increase the value just one cent more than the last offer.

If you purchase the appraisal and negotiation separately, you may only receive reimbursement for the appraisal only and may be out of pocket for the cost of the negotiation.

4. LETTER OF REPRESENTATION

We will send a letter of representation to your insurance company to inform them we are representing you as your appraiser under your appraisal clause. We specify how to contact us so there is no confusion and your claim can move forward quickly.

5. CLAIM NEGOTIATION

The insurance company will hire an independent appraiser and Ken will negotiate with them on your behalf to arrive at a fair settlement. Ken has handled thousands of negotiations. Throughout his career, Ken was trained in person, in the art of negotiation by some of the best sales and negotiation trainers in the world. Including Zig Ziglar, Tom Stuker, Grant Cardone, and Oliver Connolly.

6. SETTLEMENT

Once we have an signed agreement as to the actual Fair Market Value of your vehicle, your insurance company will award your the settlement and under Oregon Law, will reimburse your appraisal cost*. *Per OAR 836-080-0240 Your insurer must reimburse your reasonable appraisal costs if the final appraised value is greater than the insurer’s last offer.

Leverage

AUTO APPRAISALS

WHO IS KEN NIX

- Ken Nix is a local Oregon Certified and Licensed Vehicle appraiser who has been authorized by ODOT to appraise vehicles in Oregon for over 12 years.

- Ken started in the automotive industry in the 1980s and has sold and appraised tens of thousands of vehicles including late model cars and trucks, Exotics, Muscle Cars, Street Rods, Vintage, Classics, Street Rods, Camper Conversions, and even Japanese right-hand drive vans while working for multiple franchises over 20 years. Ken is the independent appraiser chosen by Ron Tonkin Gran Turismo for independent vehicle assessments.

- Previously employed by Diversiform and Reynolds and Reynolds. Ken worked for years with local Automotive Dealers to market vehicles. Hundreds of Dealership owners, managers, and staff know and trust him. Ken also worked with Lanphere Enterprises, and many other local dealers to provide digital solutions for automotive marketing.

- Ken is the founder of Volkswagen Owners Club, My GTI, and Jetta Junkie and was an Administrator for Autoguide.com for over 10 years.

- Ken’s wife jokes that sometimes she’s married to Liam Neeson because Ken has a very particular set of skills, skills he’s acquired over a very long career.

- Ken has actual long term automotive sales, appraisal and negotiation experience. Beware long term businesses with inexperienced vehicle appraisers claiming decades of experience because a relative founded the business. Make sure your automotive appraiser has the real world experience to back up their claims.

- Ken’s background in training salespeople on Product Knowledge, combined with auto body repair assessment experience and his computer background provides negotiating leverage over opposing appraisers. The ability to spot bad repairs from prior damage on an opposing appraiser’s comparables to discrediting salt state and flood damaged vehicles used by your insurance company’s valuations from CCC One and Mitchell / J.D. Powers to lowball your vehicle.

- Expert Negotiator. Personally trained one on one by Zig Ziglar, Tom Stuker, and Grant Cordone. Over 40 years experience as a professional negotiator.

- Ken’s Automotive, Computer Technology, Legal Reseach, and Negotiating background provides a very specific skill set that makes him a nightmare to opposing appraisers.

Recent Total Loss Claims

2005 Dodge Ram 3500 SLT

Settlement Increase: $5,750.00

Details

-

Total Loss Dispute Appraisal and negotiation.

-

Insurance Offer: $18,750.00

-

Settlement: $24,500.00

-

Increase of: $5,750.00

2020 Ford F-550

Settlement Increase: $14,405.00

Details

- Total Loss Dispute Truck Appraisal Clause Negotiation.

- Insurance Offer: $10,954.00

- Settlement: $15,700.00

- Increase of: $4,746.00

2017 Nissan Sentra "Stolen Vehicle"

Settlement Increase: $4,746.00

Details

-

Total Loss Dispute Appraisal and negotiation.

-

Insurance Offer: $18,750.00

-

Settlement: $24,500.00

-

Increase of: $5,750.00

2019 Ford Ranger Lariat SuperCrew

Settlement Increase: $2,573.00

Details

- Insurance company: National General Insurance

- Initial Valuation: CCC One Market Valuation Report

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $40,427.00

- Settlement: $43,0500.00

- Increase of: $2,573.00

Mitsubishi EVO

Settlement Increase: $9,417.00

Details

- Farmers Insurance Total Loss Appraisal clause dispute

- CCC One Valuation

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $18,833.00

- Settlement: $28,250.00

- Increase of: $9,417.00

2020 GMC Yukon SLT 4WD

Settlement Increase: $10,286.00

Details

- Progressive Insurance Total Loss Dispute

- Mitchel / J.D. Powers Valuation

- Total Loss Dispute Appraisal and negotiation.

- Insurance Offer: $50,214.00

- Settlement: $60,500.00

- Increase of: $10,286.00

RECENT TOTAL LOSS SETTLEMENTS

Insurance Total Loss Negotiations by Ken Nix, an Oregon Licensed and Certified Total Loss Appraiser.

-ALLSTATE – 2014 Jaguar XJ – September 19, 2022

Portland, Oregon

Offer: $22,407

Settlement: $26,500

Increase: $4,093

-USAA: 1971 Ford Bronco – September 20, 2022

Klamath Falls, Oregon

Original Offer: 63258.00

Settlement: $72,000

Increase: $8,742.00

-Progressive 2005 Dodge Neon SRT-4 – September 20, 2022

Yakima, Washington

Initial Offer: $4,543

Settlement: $12,626

Increase: $8,083.00

-Progressive 2007 Toyota Prius – August 25, 2022

Portland, Oregon

Initial Offer: $7,449.95

Settlement: $13,000

Increase: $5,550

Vancouver, WA.

Call us now for a free Claim Review: 503.420.3001

LEVERAGE

Auto Appraisals

(503) 420-3001

Location

Portland, OR. 97225

Open Hours

Mon:10am – 5pm

Tue: 10am – 5pm

Wed: 10am – 5pm

Thur: 10am – 5pm

Fri: 10am – 5pm

Sat: 10am – 5pm

Sun: Closed