Leverage Auto Appraisals Reviews

Has your car or truck been declared a total loss?

Has your Insurance Company offered you less than what your car is actually worth?

You need LEVERAGE

Check out our 135+ 5 Star Google Reviews Below.

YES! We’re local here in Oregon. Getting Oregonians what they’re owed for over 14 years.

We work for you, Not the Insurance Companies. True Unbiased Appraisal Services.

Things to ask an appraisal company:

- Do you also work for any insurance company in any capacity?

- Will you take a percentage of my claim?

- Will I recover 100% of the cost of the appraisal services including negotiation costs if you increase the value one cent in Oregon?

- Where is your company from? FYI, many out of state appraisers are not licensed to appraise vehicles in Oregon. They get a $10k increase? You may see it reversed because they were not authorized by ODOT to appraise vehicles in Oregon.

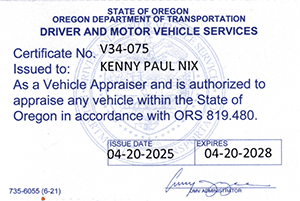

ODOT Licensed Vehicle Appraiser #V34-075

He immediately explain all of details on how it works and how do you insurance company use he gives you the low number? KEN WHEN'S ABLE TO GET ME OVER $9000 MORE THAN YOU INSURANCE COMPANY OFFERED? I WOULD DEFINITELY GIVE A 5 STAR REVIEW. AND WHAT? HIGHLY RECOMMENDED HIM THANK YOU HOWARD BERGMAN.

State Farm offered us $9,533 for our totaled car. I spent 30 minutes reading their report and then looking at various sites online for what it would cost us to buy a comparable car. It was clear their offer was majorly low balling us. From what I've since learned, they basically always low ball you.

Anyhow, I hired Ken / Leverage Auto Appraisals. We had one call, I sent him his fee, and from there I literally had to do zero work. He negotiated a settlement of $11,750, for an increase of $2,217. State Farm promptly sent us the check, as well as the reimbursement for Ken's fee.

I had some initial hesitation over having to pay his fee up front, though based on his word with how successful he is, reading over all these positive reviews, and my own sense of the initial offer being too low, I decided that the chances of getting a valuation of at least one dollar more were very, very high, which would mean they would also reimburse the fee. Glad I did it.

Thanks, Ken!

Ken at Leverage Auto Appraisals provided expert assistance. He navigated the insurance process on the our behalf. Though the negotiation with Progressive took about a year, Ken's persistence led to a successful outcome. He negotiated a $26,000 settlement for the totaled truck, significantly higher than the original offer. I believe the key for us, in the negotiations, was to have patients and give Ken the space operate.

Ken was knowledgeable and communicative. If facing a total loss claim and believing the insurance company's offer is too low, consider contacting Ken at Leverage Auto Appraisals.

While not only fighting for me as a client he is very informative and knowledgeable on all kinds of cases. He has helped me understand the situation and going beyond what is required to help make sure things get settled properly. Even with my appraisal being settled he is further helping me fight USAA to do the right thing, for this I am truly grateful to hear a voice that cares.

11/10

I tried to prove our case to the insurance company, but they put up more obstacles and excuses, claiming our comps were too old, then they were too new, then they were not the exact same trim, etc. Having been a member in good standing for over 30 years, this was both disappointing and costly process for our family.

Ken got to work immediately and provided very clear insight on the process and his experience. Within one month, USAA sent us a check for an additional $5,500 to make up the difference for the revised and substantiated appraisal. Thank you Ken!

Ken helped ease some stress and confusion I had and I greatly appreciate all the help

We are here for Oregon drivers and beyond, whether it is an insurance value dispute or just figuring out what to do next. Don’t hesitate to reach out again if anything else comes up. We are just a phone call away.

Kind regards,

Ken

There is a law in Oregon that if the appraisal increases from insurance offer by even $0.01 that insurance company must reimburse you for the appraisal, so Liberty Mutual also got stuck paying Ken for his service and my total cost for Ken's service was $0. Only downside is that the process takes a couple weeks.....that's probably part of the game where insurance company hopes you just sign whatever they put in front of you. I will recommend Ken to everyone that I know who is in a similar position in the future.

And you're absolutely right about Oregon law. Because the final settlement exceeded Liberty’s offer by more than a penny, they had to reimburse you for the full appraisal cost. I’ll never stop reminding folks—when done right, the appraisal clause doesn’t cost the consumer anything in the end. Thank you for putting your trust in me, and I’m grateful for your recommendation.

Kind regards,

Ken

It’s an honor to be your advocate when the insurance company won’t step up. I’m especially grateful you’re already recommending me to family—that's the best compliment I could ask for.

Kind regards,

Ken

Thank you again for your trust, your review, and your willingness to refer others my way. That kind of support helps keep the playing field a little more level when insurance companies try to shortchange people. I'm always happy to step in and make things right.

Kind regards,

Ken

I’m glad we could put my knowledge of the appraisal clause and insurance world to good use and get you the result you deserved. It means a lot that you’d recommend me so highly. You made the process smooth and enjoyable, and I’m always here if you or anyone you know needs help down the road.

Kind regards,

Ken

I was WRONG. It was a gigantic, time-wasting headache. After spending a bunch of time gathering and submitting documentation to prove that their settlement offer was absurdly low they agreed and increased their offer by $500 - ridiculous.

At this point I engaged Ken to help. He was a steady hand through the entire process and provided a real education on how this whole dumb system works. In the end he was able to get the offer increased by over $8k (!) which made the final settlement much closer to what the value of the car was.

If you find yourself in a similar situation I suggest not wasting your time trying to do it yourself. Just hire Ken. He'll do a great job, take all the guess-work out of it and will almost definitely get you more money.

Also, if he gets the insurance company to increase their offer by any amount then they are obligated to reimburse you for Ken's fee!

Thanks Ken!

Thanks again Kepha!

-Ken

Was hit by another motorist recently hard enough that my car was totaled. Travelers Insurance tried to low ball me on my total loss claim by 4k.

Ken went to bat for me against the new appraiser they hired for the appraisal clause. Ken was able to get me another 2k to help supplement the loss of my vehicle and the cost to get into another one.

If your car is totaled and the claim is under what the car is valued by a good amount, don't second guess - hire Ken to represent you.

Insurance companies often start with a lowball offer, hoping policyholders will accept it without question. In your case, they undervalued your vehicle by about $4,000. While the appraiser they hired out of Texas attempted to minimize the increase using questionable tactics, we still secured an additional $2,000—money that helps bridge the gap to a comparable replacement. Plus, they had to reimburse you 100% for the appraisal.

Unfortunately, I’m seeing more insurance companies hiring appraisers who are more focused on limiting increases than providing fair market valuations. Many of these appraisers are out-of-state and unfamiliar with Oregon’s market, yet they determine values that impact local policyholders. Additionally, I’ve noticed several OUT OF STATE companies claiming to be “FAIR” yet they require policyholders to pay a percentage of the increase before finalizing the award—fees that insurance companies don’t reimburse. These tactics put consumers at a disadvantage. They also claim to have reviews, but are no where to be found online, neither is their actual true contact information. Not to mention, they're not licensed to appraise vehicles in Oregon, but certified by a company out of Texas that isn't certified by any government agency.

I fight against these practices every day to ensure people like you aren’t shortchanged. I’m grateful you trusted me to handle your claim, and I’m glad we achieved a better outcome. If you ever need help in the future, don’t hesitate to reach out. Thanks again for your review!

—Ken

We take pride in providing detailed, accurate appraisals and ensuring our clients fully understand the process. Clear communication is a priority because insurance claims can be confusing, and too many companies take advantage of that lack of knowledge. I’m glad we could make the process seamless for you.

If you ever need assistance in the future, whether it’s another appraisal or just advice on dealing with insurance claims, don’t hesitate to reach out. Your recommendation means a lot, and I truly appreciate you taking the time to share your experience.

Thanks again!

—Ken

Rare and unique vehicles are often undervalued because insurers rely on flawed automated systems that fail to recognize their true market worth. I make it a priority to research and present accurate valuations so my clients get what they actually deserve. I'm also happy we were able to reach a fair settlement quickly!

Additionally, per **Oregon law OAR 836-080-0240**, **State Farm was required to reimburse you 100% of our appraisal fee**, meaning you not only secured a significantly higher payout but also had your appraisal costs fully covered.

I truly appreciate your recommendation, and if you ever need help in the future, don’t hesitate to reach out. Thanks again for trusting me with your claim!

—Ken

I know how overwhelming a total loss can be, especially when dealing with an insurance company that’s trying to undercut the true value of your vehicle. I’m glad I was able to step in and secure a **$8,800 settlement** on your **State Farm total loss claim** in less than a month. That’s exactly why I do what I do—to make sure people like you aren’t left shortchanged.

Also, per **Oregon law OAR 836-080-0240**, **State Farm was required to reimburse you 100% of the appraisal fee**, meaning you got the full benefit of the increase without any out-of-pocket cost for the appraisal itself.

Enjoy that well-deserved vacation, and if you ever need help in the future, don’t hesitate to reach out. Thanks again for trusting me with your claim!

—Ken

Also, per **Oregon law OAR 836-080-0240**, **State Farm was required to reimburse you 100% of the appraisal fee**, so not only did you receive a higher payout, but your appraisal costs were fully covered as well.

I appreciate your kind words and for trusting me with your claim. If you ever need help again, don’t hesitate to reach out!

—Ken

It’s also important to mention that if you had used the **"FAIR"** company, they would have charged **$300 upfront** for the appraisal and then taken **15% of the increase**—which in your case would have been an additional **$1,050.90**. That means you would have lost **$1,350.90** from your final settlement, and **Progressive would have only been required to reimburse you for the $300 appraisal fee**. The rest would have come straight out of your pocket.

In my personal opinion, I feel this is akin to a **bait-and-switch scam**—they lure people in with a low initial fee, but once they secure an increase, they take a significant percentage of the payout. Meanwhile, they market themselves as a no-risk option, when in reality, clients end up paying far more than they should.

By choosing me, you **kept 100% of the increase**, and **Progressive was required to reimburse you for the full cost of our appraisal** as per **Oregon law OAR 836-080-0240**. That’s how it should be—fair, transparent, and in the best interest of the policyholder.

I appreciate you trusting me to fight for a fair valuation, and I’m glad we could achieve this strong result. If you ever need assistance again, don’t hesitate to reach out. Thanks again for your review and for choosing me to handle your claim!

—Ken

with appraisers due to the recent on-slot of hurricane-damaged cars. He was patient in explaining the process and helpful in coming to a resolution with the insurance company.

Ken is friendly, knowledgable, thorough and trustworthy!

Insurance companies often try to minimize payouts, but I make sure my clients don’t get shortchanged. Thorough research, market knowledge, and persistence are key to getting a fair settlement. I truly appreciate your trust in me to handle your claim and fight for what you deserved.

If you ever need assistance in the future, don’t hesitate to reach out. Thanks again for your support!

—Ken

Your experience is, unfortunately, a common one—insurance companies start with a lowball offer, and even when policyholders push back, they make only minimal adjustments. That’s why having an experienced appraiser on your side makes all the difference.

I truly appreciate your trust and recommendation. If you ever need assistance again or know someone else facing a total loss, don’t hesitate to reach out. Thanks again for choosing Leverage Auto Appraisals!

—Ken

Unfortunately I was in an accident and the body shop and insurance company said it was a total loss. I did as instructed and was able to find two or three comps with similar mileage, year of MFG, and options in my area. My insurance company total loss agent used the same comps, but sent me a check for several thousand dollars less than the comps? The total loss agent told me the reduction was for depreciation of the comps ??

I tried to reason with the total loss insurance agent, and told him that, just like the cost of grocery’s and gas… inflation controls the cost of used vehicles also. Costs have appreciated not depreciated. The total loss agent still wouldn’t budge.

That’s when I called Leverage Auto Appraisals and spoke with Ken.

I hired Leverage Auto Appraisals and invoked the Appraisal Clause.

My truck was appraised for $4233 higher.

I received a check from the same insurance total loss agent that wouldn’t budge for $4233, and another from the same agent for total reimbursement of the appraisal fee.😊

Don’t let insurance companies take advantage of your emotions, stress and financial circumstances after a total loss.

Hire Leverage Auto Appraisals. It literally cost me zero and saved me thousands.

You’re absolutely right—vehicle prices, like groceries and gas, have appreciated, not depreciated. Yet, insurance companies often manipulate valuations by applying unnecessary deductions, hoping policyholders will just accept them. By invoking the Appraisal Clause and hiring me, you were able to get the fair value you deserved, and State Farm was required to reimburse you 100% of the appraisal fee, making it a win-win.

I appreciate you trusting Leverage Auto Appraisals to handle your claim, and I hope your next truck serves you well throughout your retirement! If you ever need assistance again, don’t hesitate to reach out. Thanks again for the review!

—Ken

Ken

Ken has great communication considering how swamped appraisers are now. When I first spoke to him with concerns (before even hiring him), he took the time to answer all my questions in great detail. While no appraiser can guarantee how an appraisal will go, Ken assured me his services would be well worth the cost. And he was right! Less than 1 week after hiring him, I got an email from my claim agent stating they had increased my loss value by about $1800!

I’m so glad I didn’t just immediately accept my insurance’s offer, and I’m especially glad I found someone as reliable and professional as Ken!!

In your case we secured a $5,396 increase from State Farm’s final offer which is a fantastic result. I do believe your Jeep Wrangler was worth more given its lower mileage but being a 2004 with very low miles and in much better condition that 98% of 2004 Jeeps out there made it challenging to build a higher credible valuation with the available comparable vehicles. Many of the comps had higher miles, prior damage, improper repairs, or even current damage while being listed at much lower values. Which makes it harder to quantify or discredit, especially if there is no damage history or visible damage on the opposing appraiser's comps. In comparison someone could purchase a four-year newer Wrangler with about 10,000 more miles for the same value we settled for. That had to be considered in our negotiation.

The extended timeline for your claim reflects my commitment to not settling for less. I will not take the path of least resistance or agree to a lowball offer just to expedite negotiations. If I believe a significant increase is achievable I continue to fight for my clients even if it takes longer.

Recently negotiations have slowed due to the large volume of claims following the hurricanes. Many large appraisal companies hired by insurers are overwhelmed with appraisers handling 75 to 150 assignments per month which is far beyond what allows for quality work. In comparison, I only took on 25 assignments last month which gives me time to actually work each claim to the best of my ability. Many of these appraisers are from out of state and are not licensed or authorized to produce appraisals in Oregon and are using comps from the East Coast, Salt States, etc to lowball valueations.

Over the past 14 years, I have been able to disqualify a large number of out of state appraisers. Unfortunately due to changes in ODOT's rules, since January 2024 it has become nearly impossible to disqualify these appraisers if they are working for an insurance company.

Thank you again for your patience and trust in me. I am so glad we were able to achieve such a strong outcome for your claim.

Thank you, Ron! That was indeed a nice settlement, though it was a very challenging claim. I’m honestly surprised the opposing appraiser didn’t push for an umpire earlier, especially with an increase this significant. Lately, whenever we’re aiming for a large increase, opposing appraisers are quick to push to go to umpire. A system that, in my personal opinion, often favors insurers, as most umpires have close ties with them.

It’s also interesting to see more appraisers targeting the Pacific Northwest from places like Florida, Utah, Michigan, and California. Many of them are the same opposing appraisers I encounter working for insurance companies in other claims. I appreciate you choosing me as your auto appraiser and taking the time to write a review.

If you are wondering if it’ll be worth it, give him a call and he’ll look over your case and tell you if he thinks he can get you more.

Ken got me over $4,000 more out of my auto claim (140% of what my insurance offered me! Took me from 10k I was offered to 14k my car was actually worth). Plus in Oregon if your settlement increases at all, insurance has to reimburse you for all his costs. So at zero cost to me, I got a huge monetary increase.

From start to finish, Ken explained the process to me, kept me updated, pushed my insurance to move much faster than they would have otherwise, and really helped me feel like I was appropriately compensated after a hit and run.

Anyone and everyone who experiences a total loss should use his services. I will always go to him in the future if anything like this happens again, and would tell friends and family to do the same.

Thanks to everyone at Leverage, and especially Ken!

I knew that my truck had intrinsic value, and so did Ken.

A Pre-Def '06 GMC 2500HD LBZ Diesel. Those who Know, Know!

Well...Wow!!! Ken got me the amount that truck would have brought if I could have sold it.

An increase of 61% over what the insurance company had insulted me with in their initial offer.

A total increase of $12,800

If you need someone who understands what you're dealing with, and will fight to get you what you deserve from an insurance company bent on screwing you.

You need Leverage Appraisals and Ken Nix!

I was contacted by the insurance's hired appraiser when they were looking for pre-accident condition details on my car and even they mentioned they had been in negotiations with Ken over many cases in the past. His years of experience paid off for me! Thank you.

Kind regards,

Ken

I found Ken Nix, his business “Leverage Auto Appraisal” when he says he’s on your side, he truly is!

He got me way more than I could have ever expected. Not only that, what I learned from his expertise, was an eye opener! he explains every step in great detail, and breaks it down so it all makes sense.

I hope I never have to go through this again, but if we had to. Ken, you’re the man!

Thank you, for your patience, understanding and for answering my many questions and walking me through this.

OH! The best part my husband was one satisfied and amazed client!

This job certainly isn't stress-free, and my priority is always to make sure my clients are satisfied. If I worked for the insurance companies, I'd probably earn about $250 more per case on average, and I wouldn’t have to worry as much about public opinion, marketing, negotiating, or selling my appraisal services. But the path I’ve chosen, while challenging, I feel is the right one for me. It is fulfilling because I get to help people who are being taken advantage in most cases, and I’m committed to advocating for my clients and ensuring they know their rights and understand the process.

Your recognition of these efforts means the world to me. Thank you again! - Ken

Also, just to clarify for others, Freddie initially paid my fee upfront, and State Farm had to reimburse the fee per Oregon Law OAR 836-080-0240 which states: "Your insurer must reimburse your reasonable appraisal costs if the final appraised value is greater than the insurer’s last offer."

- Ken Nix

It's very concerning that many out-of-state appraisers are now targeting Oregon in the last few months, most appear to be working for the insurance companies as many of them are the same opposing appraisers I'm having to fight against. Some even claim to be "insiders" because of their previous work with insurers as adjusters..... Yeah, I bet they're just very ethical and would never be biased against someone paying them a small amount even though they're making $100k a year from the same insurance company.

Then I look at the skyrocketing online advertising costs, driven up from $2.52 last August, to $92.09 per click over the last few months due to these new out of state appraisers. My question is what business model makes this logical? I've been very fortunate to have supportive clients like you who post reviews. This helps others understand that I strive to secure fair settlements, not low ball offers. I only do approximately 20-25 appraisals per month, so I'm not looking for the path of least resistance like some of these companies doing 150 appraisals per month. I actually work the claim and audit the opposing appraiser's appraisal and comps. Thank you Jason for helping spread the word! I appreciate you taking your time.

Kind regards,

Ken

ps. I apologize for ranting, but it's not fair what's going on lately. People pay their premiums, but are being low balled with comparable vehicles that have no photos, and questionable condition when they have a claim? Some of these valuations I'm seeing have comparables with Branded Titles, structural damage, 3-4 prior accidents, bad repairs, and even thousands in current damage. Things that make you go hmmmmmm..........

Thank you, David! I really appreciate you taking the time to write a review. Makes me feel good to be able to get the extra $3,300 you should have been offered to begin with. It's crazy how low some of these valuations have been recently. I was reviewing my records this morning, and out of 84 claims I've settled in the past few months, only 18 had increases of less than $3,000. This should never happen. Before the pandemic, only about 20-30% of the appraisal clause claims I worked on saw increases over $3,000. Now it's reverse???? Something really weird is going on in my opinion.

Your case highlights the importance of a thorough and expert appraisal process. The CCC ONE valuation initially deducted $1,895 from your vehicle compared to a similar vehicle with over 18,000 more miles, which was a clear oversight. Additionally, State Farm's CCC ONE valuation used comparables that were not the correct model trim, without making necessary adjustments for this discrepancy. Such inaccuracies can severely impact the Actual Cash Value and ultimately your settlement.

As a licensed auto appraiser specializing in Total Loss Appraisal and Car Appraisal, my goal is to ensure that clients like you receive fair and accurate valuations. I leverage local market knowledge and detailed research to dispute total loss insurance claims effectively. Your experience underscores the critical need to challenge unfair valuations and seek adjustments based on accurate comparables and realistic market conditions.

It's important to note that many appraisers out there work for insurance companies. While they may claim to be unbiased and "on your side," if they are earning $100k a year from claims provided by insurance companies, their loyalty might not truly lie with the consumer. Recently, there has been an influx of appraisers advertising in the Oregon area from places like Seattle, California, Georgia, and even Canada. These appraisers often don't realize we don't have an 8% sales tax in Oregon. They may claim to be "local," but in reality, they only have a PO Box in Oregon.

I am grateful for your loyalty and pleased to see our efforts lead to such substantial financial gains. Your feedback is invaluable, and I remain committed to providing exceptional service and support to all my clients.

Thank you once again for choosing my services for your total loss disputes. Should you or anyone you know need assistance with a total loss insurance claim, please do not hesitate to reach out.

Best regards,

Ken Nix

Leverage Auto Appraisals

★★★★★★★★★★

If I could, I'd give Ken 10 ★s!! Ken Nix is a great advocate!! We were the original owners of a 1991 Toyota Land Cruiser; it was stolen from the “secured” parking garage at our apartment in downtown Portland. We hardly ever drove it, so we didn't discover the cruiser was stolen for nearly a week. A couple days later I fell and broke my jaw & 2 ribs, so we had a LOT of stress going on. PDXstolencars (dot) com helped us locate the car, but the thieves totaled it - then State Farm tried to lowball us on the ACV.

I started doing research on what to do when your insurance company undervalues your total loss vehicle and “stumbled upon” Ken Nix; well, that must have been an act of Grace, because Ken negotiated our settlement and not only got an increase in our ACV payout, but also helped alleviate the intense stress of the situation.

When one is facing an unfamiliar state of affairs (i.e. the loss of your 33 yr old beloved land cruiser that's recently transitioned to the status of a “collector's car”), one needs an advocate that's not only well-versed in the domain of vehicle valuation and appraisal, but also knows the local players involved. In Oregon, you also need that appraiser to be licensed w/the Oregon Dept of Transportation.

Ken Nix is your guy!! Ken ONLY advocates for regular people, not for the insurance companies. Everything he told us was accurate, and it all played out just as he expected. If you're facing the total loss of your vehicle, just call Ken Nix… you'll be glad you did!! ★★★★★★★★★★

Navigating a State Farm Appraisal Clause Dispute Claim under such circumstances is challenging, and I commend your resilience. I'm glad I could assist in this difficult time by negotiating an increase in the Actual Cash Value (ACV) payout from State Farm. Your praise for my expertise, local knowledge, and dedication to advocating for regular people, not insurance companies, means a lot to me.

As a licensed auto appraiser specializing in Total Loss Appraisal and Car Appraisal, I focus on ensuring fair and accurate valuations for my clients. In your case, the initial CCC ONE valuation by State Farm undervalued your Land Cruiser. It is essential to challenge such lowball offers, as they often do not reflect the true market value, especially when relying on inaccurate comparables or incorrect CCC ONE Valuation data.

Thank you for acknowledging the importance of knowing the local dealers, market, and area. Recently, there has been an influx of appraisers from places like Seattle, Florida, Georgia, California, and even Canada, who often charge policyholders $225 for an appraisal to "hook" them, then add $300 per hour or even 50% of the increase to negotiate the claim. Because their appraisals are low, insurance companies only reimburse the $225 appraisal cost, not the full $725 it actually costs, as the separate negotiation charge is not part of the appraisal. This practice seems nearly like bait and switch and raises questions about who their true client is—policyholders or insurance companies.

That's why I refuse to work for insurance companies. Even if appraisers make a conscious decision to be unbiased, the significant amount of business they receive from insurance companies can unconsciously influence their valuations. Ensuring that my clients receive fair settlements without any conflict of interest is my top priority.

I am grateful for your loyalty and pleased to see our efforts lead to a fair settlement. Your feedback is invaluable, and I remain committed to providing exceptional service and support to all my clients.

Thank you once again for placing your trust in my services during such a stressful time. Should you or anyone you know need assistance with a total loss dispute or any other car appraisal needs, please do not hesitate to reach out.

Best regards,

Ken Nix

Leverage Auto Appraisals

Achieving such a significant increase in the Market Value payout underscores the importance of a thorough and expert appraisal process. As a licensed auto appraiser specializing in Total Loss Appraisal and Car Appraisal, I am dedicated to providing accurate and fair valuations for all my clients. It's all too common for initial offers from insurance companies to be low, often based on incomplete or incorrect data from CCC ONE valuations or JD Powers Valuations.

By carefully analyzing the market and ensuring that all factors are considered, I strive to dispute total loss insurance claims effectively and secure the settlements my clients deserve. Your case is a perfect example of why it's crucial to have a quality appraiser on your side.

Thank you again for your trust and for recognizing my expertise and efforts. Should you or anyone you know need assistance with a total loss dispute or any other car appraisal needs, please do not hesitate to reach out. I remain committed to providing exceptional service and support to all my clients.

Best regards,

Ken Nix

Leverage Auto Appraisals

Dealing with a total loss insurance appraisal clause claim for a unique vehicle, especially one stolen, presents specific challenges. Diesel trucks like yours have become common targets for car thieves lately, adding to the stress and complexity of the situation. The initial resistance from the insurance company to offer a fair settlement is a common issue many clients face. The complexity of valuing a unique truck accurately often leads to low initial offers based on incomplete or incorrect data from CCC ONE or JD Powers Valuations.

This was a State Farm claim, and the initial appraisal from CCC ONE significantly undervalued your vehicle. Through thorough analysis and using my local market knowledge, I was able to increase the value by over $7,200, ensuring you received a fair settlement.I feel we should have gotten more, but again, we had to negotiate with an appraiser out of California. Funny, that's one of the same appraisers that are targeting Oregon consumers now.

As an Oregon certified and licensed auto appraiser specializing in Total Loss Vehicle Appraisals, my goal is to ensure that clients like you receive a fair and accurate Market Value settlement. I strive to dispute total loss insurance claims effectively, leveraging local market knowledge and detailed analysis to challenge lowball offers.

Your case underscores the importance of thorough and expert appraisals in achieving fair settlements, especially in difficult situations where the vehicle is unique and there are few comparable vehicles available. .

Thank you once again for your trust and patience. Should you or anyone you know need assistance with a total loss dispute or any other car appraisal needs, please do not hesitate to reach out. I remain committed to providing exceptional service and support to all my clients.

Best regards,

Ken Nix

Leverage Auto Appraisals

- Ken

It has become increasingly difficult to get a fair settlement from insurance companies. It is their job to settle a claim as cheap as possible and it's my understanding that some companies even offer bonuses to your adjuster when the claim is settled for less than it could have been. Don't fall for the biased CCC One valuations!

I was offered less than market value for my totaled car, calling it "actual cash value". When I kindly suggested that they were not being fair, they LOWERED the original offer by about $1000.

The insurance appointed their own "independent" appraiser that agreed with their low ball value (no surprise.) Ken stepped in and held them accountable. He got me even MORE than I was asking for my car, raising my valuation by nearly 30% and my insurance company paid his fee because Oregon law requires them to if Ken increases the settlement by even 1¢!

Be patient with Ken, some cases are harder than others and he is a "one man show". Trust his process and he will get you good results!

You hit the nail on the head about the insurance game. It's frustrating how they play hardball, lowballing offers and then daring to slash the price further when challenged. It's like they're testing to see if we'll just fold and accept whatever crumbs they throw our way.

Your situation was a classic case of the insurance runaround. Stepping in to challenge that was exactly the kind of mission I gear up for. I'm glad I didn’t just meet your expectations. And yep, thanks to Oregon law, State Farm insurance company had to foot the bill for my fees, which is always a satisfying bonus for my clients in the end!

I know my one-man operation can test patience sometimes, but I'm all about quality over quantity. Your trust in me paid off, and we showed them what fairness really looks like.

Thanks a ton for your support and for sharing your story. It's experiences like yours that fire me up and keep me fighting the good fight. If you or anyone you need help again, I'm just a call or email away. Here’s to standing up to the giants and winning! - Ken

On my last claim he found out that progressive has used a salvage titled vehicle as a comparable to my immaculate low mile diesel truck which actually got me paid back for the trucks current value.

I recommend Ken on a regular basis to my friends who are unaware of what insurance companies try to do to you. I can tell you from experience he is a true car enthusiast and will go ABOVE AND BEYOND for his customers and he will fight for you. I wouldn’t be driving the truck I have now without his help.

Thanks again, Ken!

Keep doing what you’re doing! You’re the best. Hope all is well.

Thank you Ken!

Ken

Kind regards,

Ken

If your car is totaled, it is guaranteed that your insurance company will give you a low offer and try to rip you off. Ken does all the work of dealing with the appraiser hired by the insurance company to negotiate on your behalf. Other places will quote you a lower price than Ken, but they will just present you a report and you are on your own. Ken actually negotiates with the insurance company's appraiser to get you the best deal.

Also -- if you live in Oregon -- the insurance company will have to reimburse you for the amount that you pay for Ken as long as Ken can get you at least one penny more than their offer.

To summarize: I hired Ken and paid him $499. Ken was able to get me $2,400 more than my insurance company offered me and my insurance company reimbursed me for the $499 that I paid Ken.

Just send Ken your insurance company's valuation report and if he knows that he can get you more, he will take your case and you will be reimbursed for what you paid him. You literally have nothing to lose.

Dealing with California Casualty, brought its challenges, especially considering the age of your car versus its low mileage, which they significantly undervalued. It's a classic example of insurance companies trying to lowball, but we proved that your Prius was worth much more, achieving a 52 percent increase.

Your situation highlights why it's crucial to have someone in your corner who’s willing to roll up their sleeves and negotiate directly with the insurance appraiser. Unlike some services that just hand over a report and leave you to fend for yourself, I'm committed to seeing the process through, ensuring we reach the best possible outcome.

And yes, for Oregon residents, it's a win-win situation. The fact that you got reimbursed the fee for my services is just icing on the cake. I haven't raised our fee for over 6 years, even though I'm having to pay a lot more for research tools. Oregon reimbursement policy is something many don't know about, and I'm glad we could use it to your advantage.

I appreciate your kind words and the trust you placed in Leverage Auto Appraisals. Stories like yours are why I do what I do—fighting to get every penny my clients deserve. If you or someone you know ever needs help again, I’m just a call away. Thanks again for sharing your experience and helping spread the word about the importance of the Total Loss Appraisal process.

- Ken

Your experience underscores the importance of not simply accepting initial insurance offers. It's a lesson many can benefit from, and I'm glad we could navigate this together to achieve such a positive outcome.

On a related note, I'd like to share some insights that might be helpful for others reading this review. Recently, there's been a worrying trend in our industry. Appraisers from out of state are flooding the market, often lowballing their appraisal fees and then claiming a portion of the settlement. This practice is concerning because, in many cases, they charge exorbitant rates for claim negotiation or even demand up to 50% of the claim's value.

For context, if I operated on a similar 50% commission basis, my earnings over the last four months would have been over $200,000, instead of the $43,000 I actually earned. This highlights the substantial impact these practices can have on both professionals in the field and policyholders.

Furthermore, many of these appraisers aren't licensed to operate in Oregon, a critical issue that seems to be overlooked by regulatory bodies. This lack of oversight could have significant implications for vehicle owners and policyholders.

Your review, Justin, brings much-needed attention to not only these issues, but the fact that many of these high volume appraisal companies are working for the insurance companies and appear to be taking the path of least resistance to settle quickly instead of for what vehicles are actually worth. It's been a pleasure working with you, and I'm here should you need any further assistance or advice in the future. Best wishes, Ken

Navigating insurance total loss appraisal clause claims can indeed be a complex and sometimes overwhelming process. I'm dedicated to ensure that my clients are empowered with the knowledge and support they need to get what they rightfully deserve, and make the insurance companies get what they rightfully deserve too. Your recognition of this aspect of my work means a lot to me.

I'm glad to have been able to assist you in dealing with your insurance agency. It's important that policyholders understand their rights and the full potential of their policies, and I'm here to help bridge that gap.

Thank you once again for your recommendation and trust in my services. Please feel free to reach out if you need any more assistance or advice in the future. Best regards, Ken

Lately, my availability has been more limited due to the influx of out-of-state appraisers who are not familiar with our unique market in the Pacific Northwest, and particularly in Oregon. Our region has its own set of market dynamics, including the absence of sales tax, which significantly impacts vehicle valuations. Additionally, many of these appraisers come from areas where the cost of living is substantially lower and road conditions differ notably, like places where roads are salted. This necessitates more extensive explanations and advocacy on behalf of my clients to ensure they receive fair settlements.

I want to emphasize that my motivation for becoming a vehicle appraiser was not driven by financial gain but by a genuine desire to help people secure fair settlements. It's important to me that each client receives the attention and expertise needed to navigate these complex situations effectively.

Thank you again for placing your trust in me. Your recognition of the effort and ethics behind my work is truly appreciated. Please remember, I'm here if you or your son need any further assistance in the future. thank you again, Ken

Your recommendation means a great deal to me. It reinforces my commitment to perseverance and fairness in all my appraisals. In the current market, especially with the challenges we face in Oregon, achieving such results requires a thorough understanding and a determined approach, and I'm glad we could navigate this successfully together.

Remember, my door is always open for any further assistance you might need in the future. I'm here to help, whether it's for a new case or simply to offer advice. Kind regards, Ken

It was truly a pleasure working alongside you, especially in helping you receive a more accurate and deserving value for your 2013 BMW X1 sDrive 28i. Such unique vehicles demand a keen understanding and appreciation of their worth, and I'm glad we could ensure you got a fair deal.

Your acknowledgment serves as a testament to the dedication we have in serving our clients to the best of our ability. If you ever need any further assistance or guidance in the future, please don't hesitate to reach out.

Warm regards,

Ken Nix

Leverage Auto Appraisals

I'm glad to have been able to assist in getting a more accurate and just valuation for your vehicle. That extra 15% represents not just an increase in numbers, but a testament to ensuring fairness in what can sometimes be a complex negotiation process with insurance companies when dealing with a totaled vehicle.

Your acknowledgment is very much appreciated and means a lot, and I'm here to assist if you ever require any further guidance or assistance in the future.

Warm regards,

Ken Nix

Leverage Auto Appraisals

I have been a law enforcement officer for over 27 years and this was my first experience in having a vehicle I owned that was totalled and challenged the insurance company as to the value of the vehicle. As time went on (3 months), Mr Nix kept me informed of the all information that was needed and how the process was moving forward.

Mr. Nix eventually negotiated a deal that increased the offer from $35,000 to $52,000 which is nearly a 50% increase in value ($17,000 more)!

Mr. Nix is a firm but fair negotiator that gets the job done! I would highly recommend him as your negotiator to extract the best deal for you possible!

Thank you Kenny Nix,

Michael Leary

I genuinely apologize for the length of time it took to finalize the claim on your behalf. A primary factor in the delay was the necessity to reestablish the exact date of loss and the condition of the vehicle at the time of the incident with the opposing appraiser and insurance company. It's crucial to understand that the initial valuation presented was not based on the correct details. Sorting out the facts and ensuring every piece of information was accurate with both the insurance company and their appraiser was paramount, but did unfortunately require additional time.

At Leverage Auto Appraisals, I personally oversee every appraisal, negotiation, and audit of opposing appraisals. This hands-on approach is to guarantee that the quality and accuracy of our services meet the high standards I set for myself and for our company. Unlike larger firms, where appraisals and even negotiations may be performed by those less experienced or who might not carry the same dedication to truly proving a vehicle's worth, I ensure that each step in the process adheres to the highest standard. My commitment has always been to prove the value, not merely produce one.

Again, I deeply appreciate your patience and understanding throughout the process. The aim was to ensure you received the value you deserved for your vehicle, and I'm grateful we could achieve a favorable outcome for you. Michael, your recommendation means the world to me, and it has been an honor to assist a dedicated law enforcement officer like yourself.

Wishing you all the best and please feel free to reach out if you need any further assistance in the future.

Warm regards,

Kenny Nix

Leverage Auto Appraisals |Total Loss Appraiser

It truly is remarkable that we managed to more than double the value of the Market Report originally provided by Progressive Insurance. Standard valuations can often fall short in recognizing the true worth of vehicles that have undergone significant modifications, and it's always my mission to ensure that such unique attributes are given their due consideration.

I'm genuinely delighted to have been able to assist you in ensuring that you were treated fairly and received an accurate valuation for your cherished vehicle. An increase from $3,700 to $9,000 (a remarkable 118% increase) just makes me happy you reached out to me.

Thank you for placing your trust in me and Leverage Auto Appraisals. Always remember, you shouldn't feel crazy, dishonest, or guilty for expecting a fair deal. Your passion for your car and your rightful claim is evident, and I’m pleased I could play a part in making that happen.

In my opinion, it was sketchy and improper for the insurance company to attempt a renegotiation of the settlement after a signed agreement was in place. Such practices can further strain the trust between claimants and insurers. I am, however, elated that I was able to hold our ground and maintain the original, and rightful, settlement for your vehicle.

Your trust in me and in Leverage Auto Appraisals has not been taken lightly. I want you to know that neither your passion for your car nor your rightful claim went unnoticed. I’m truly honored to have played a role in ensuring you received a fair and just valuation.

Should you ever encounter any more hurdles with insurance matters in the future, do not hesitate to reach out. My dedication is to stand by our clients, ensuring they are supported and treated fairly every step of the way.

Kind regards,

Ken Nix

Leverage Auto Appraisals

Ken was a rock star and is well-known in this field. He was very responsive and talked me through the process. I appreciated that he texted and emailed as well as a chat on the phone! Very trustworthy. I think other appraisers know he knows his stuff, that is why he is so successful. Thank you Ken! I would highly recommend him to assist with a total loss settlement!

He is an honest, easy to talk to, person!

We would absolutely highly recommend Leverage for any appraisal need! Topnotch!!

The biggest problem is most people don't even know about the appraisal clause option in their policy. They just try to negotiate best the can, and finally give up.

Most people are involved in a total loss only once or twice in their lifetime if they're lucky. Insurance reps do this every day and they know every way possible to gain the advantage. Thank you again for taking the time to write a review. - ken

After months of fighting with my insurance and going nowhere if not backwards, I felt like my back was against a wall. State Farm claims adjusters were beyond nasty to deal with and actually lowered their valuation offer after I refused their first offer.

I thought I was pretty knowledgeable, so I typed up a 40+ page discrepancy review/ counter offer after I had received the CCC One valuation report, (What State Farm uses to devalue your totaled vehicle). State Farm refused to acknowledge anything I called out in my report. I was deflated and felt like nothing that I was doing was working.

I was honestly close to giving up, and just taking State Farms offer. Then while looking online at options, I found out about the Appraisal clause. Upon further searching I came across Leverage Auto Appraisals. I went to their website, and requested a free valuation of my claim. Within minutes my phone was ringing... I screened the call thinking that I just signed up for a scam. Ken left me a voicemail, which I was hesitant to return (still thinking it was a scam).

When I finally got around to getting back to Ken on the Phone we must have talked for hours. Ken explained the whole process, was super personable, friendly, and knowledgeable. (I'm sorry Ken) All of this seemed too good to be true. I truly thought this was a scam until I got a call from State Farm, and they explained that the appraisal brought the value up THOUSANDS of dollars from their original offer.

If you find yourself in a similar situation, give Ken a call. I cannot recommend this man enough. Ken... Thank you for your hard work, and for being such a stand up dude. I can't imagine where I would be if I didn't have you in my corner representing me against State Farm. Thank you.

-Cole

I understand the challenges that policyholders can face when dealing with insurance companies. It is unfortunate that some insurers may attempt to undervalue or provide unfair vehicle comparisons during the claims process. Especially trying to pay you $6,000 less than what we settled the claim for. However, I am glad that I could step in and help you navigate through this situation effectively.

I appreciate your patience throughout the process, as obtaining a fair and practical vehicle value can sometimes take time. It's important to be thorough and meticulous when assessing the worth of your vehicle, ensuring that all relevant factors are taken into consideration. I'm glad that we were able to achieve a positive outcome that reflected the true value of your truck.

If you have any further questions or require additional assistance in the future, please don't hesitate to reach out to me. I'm here to help and provide you with the best possible service.

Thank you once again for choosing Leverage Auto Appraisals, and for placing your trust in me to represent your interests. I'm truly grateful for the opportunity to have worked with you and I wish you all the best moving forward. - Ken

Thanks again, Ken

When it comes to negotiating with insurance companies, it's crucial to have a thorough understanding of the appraisal process and the factors that contribute to a vehicle's value. I'm pleased that my expertise and knowledge helped you secure a 42% increase over their offer. Your satisfaction and receiving the compensation you deserve are of utmost importance to me.

If you have any further questions or require assistance in the future, please don't hesitate to reach out. I'm here to provide ongoing support and ensure your needs are met.

Thank you for entrusting me with your appraisal needs and for sharing your positive experience. Your feedback is greatly appreciated, and I'm grateful for the opportunity to have been of service. - Ken

Thanks Mr.Ken Nix for all your help!

Dealing with insurance companies can often be a challenging task, but I make it my priority to fight for your rights and ensure you receive the fair compensation you deserve.

Thank you sincerely for sharing your appraisal success story. Your trust in me and your positive review are deeply appreciated. It is customers like you that make my job truly fulfilling. -Ken

I greatly appreciate your trust in my expertise, and I am delighted to have played a role in securing an additional $3,158 from your insurance company on your behalf. There are so many complexities of the insurance industry and I strive to navigate the process on your behalf. It is incredibly satisfying to know that my efforts have made a tangible impact on your financial recovery.

I understand how surprised you were by the initial low offer, and I'm glad I could assist you in disputing their valuation. With my years of experience in the auto industry and extensive knowledge of vehicles and modifications, I was able to provide a thorough appraisal and negotiation strategy tailored to your unique situation.

Your converted Honda Element E-Camper with the aftermarket pop-top, required a specialized understanding. By leveraging my expertise and advocating for the true value of your vehicle, we were able to secure an additional $8,000 for you. I'm thrilled that my efforts had such a significant impact on your financial recovery.

At LEVERAGE, we take pride in our ability to navigate the appraisal process and fight for fair compensation for our clients. It's rewarding to know that my knowledge and dedication resulted in a positive outcome for you.

I sincerely appreciate your trust in me as your auto appraiser, and I'm grateful for the opportunity to assist you. Should you ever require our services in the future or have any further questions, please don't hesitate to reach out.

Thank you once again for choosing me as your auto appraiser, and I wish you all the best.

It is disheartening to hear that your insurance initially offered such a low amount for your vehicle. I'm very happy I was able to get them to agree to an additional $7,000. Thank you so much for taking the time to write a review, I know it takes valuable time to do so, especially with such a nice review as you provided. Thank you so much. Sincerely, Ken Nix

These first-generation trucks in prime condition have become modern classics (especially with the suspension and transmission upgrades I had added), and my insurance company was insisting on using lowball, salvage vehicles in all their comps.

With Leverage Auto Appraisals on my side, I got a truly fair market value in the settlement. The best part was it didn't cost me anything; by Oregon law the insurer is required to reimburse appraisal fees paid by the customer if they win the dispute.

I'm glad you let others know that under Oregon law, insurance companies are required to reimburse appraisal fees paid by the customer if they are successful increasing the value. Most people don't know this at all. It's a great relief to know that my services didn't cost you anything and that you received the compensation you deserved.

If you ever need assistance in the future or have any further questions, please don't hesitate to reach out. I'm here to support you and ensure your appraisal needs are met.

Thank you once again for your positive review. Your satisfaction and success in obtaining a fair settlement mean a lot to me. I'm grateful for the opportunity to have been of service. -ken

Phil Odusanya, Tigard

I thought Geico was supposed to be on my side but it turns out they are most definitely not on my side. When my Chevy Tahoe was deemed a total loss, Geico proceeded to drag the process out over the course of 3 months trying to force me to accept a settlement that was far less than what the vehicle should have come in at.

Luckily I ran across Ken's add on the internet and I learned about how I had the right and option to hire a private appraiser. That was the best decision I had made in a long time. Although it still took a while because Geico continued to stall and drag their feet, causing me to be a little skeptical that this was going to pan out.

But then after talking with Ken he said we're almost done and a couple days later he had the appraisal and it was approximately $4,000 more than what Geico had said it was worth.

Geico was trying to cheat me out of$4,000. Geico had already cheated and left me holding a $750 debt that they refused to pay for the rental car. Regardless of whether I had rental Car coverage which I did, they said they didn't have to pay it because it was a total loss situation. Geico didn't tell me this until after I had received and used the rental car for over 30 days with approval from GEICO. Geico chose to penalize me with this debt for resisting their extremely dishonest and low-ball offer presented to me.

What they had offered didn't even pay off the loan and would have left me with nothing, but thanks to Ken I get my money back for the appraisal fee and Geico has to pay it back to me which is even better and I get what the vehicle should have paid out.

I'm not left out hanging to dry. Thank you very much Ken, I appreciate it and you are well worth the wait and the money!

Greatly Appreciated

Toby

When my car was stolen, recovered, and deemed a total loss my insurance company offered me a pittance, it wasn't even enough to replace my truck.

I reached out to Ken to ask some questions and figure out what my next steps were. After a brief conversation with Ken I paid him for his services and Ken took it from there. Not only did Ken get me what my car was actually worth, his fee was paid for by the insurance company.

Not sure if it's different for other states, but even if it is, the fee for Ken's services would have been covered by the increase in the appraised value of my car.

Thank you Ben, I understand how frustrating it can be when an insurance company undervalues your vehicle, leaving you unable to replace it adequately. I appreciate your trust in my expertise.

It's actually Oregon law that they have to reimburse the appraisal fee if we increase the settlement even one cent. My goal is always to ensure that my customers receive fair compensation for their vehicles.

If you ever find yourself in need of further assistance or have any questions, please don't hesitate to reach out.

Thank you once again for sharing your experience. Your satisfaction is my utmost priority, and I'm grateful for the opportunity to have been of service.

Ken

We had to file a claim for stolen vehicle, our insurance company fought tooth and nail and ultimately low balled us! Ken fought right back and we received $6,600 over the insurances valuation. Fair value is all we were looking for, and Mr. Nix got it for us!! 10+ stars

Though we both acknowledge that the process took much longer than needed (for a variety of reasons), I was very pleased with the outcome. Ken and I had a lengthy conversation up front where he reviewed the initial valuation to determine whether it was worth pursuing his services. Ken indicated that 80% of people in my situation don't exercise their appraisal clause due to all the hassle involved. I didn't want to be part of that 80% so I retained his services.

In the end, Ken was successful in securing $1,200+ above the original valuation. When the insurance company refused to reimburse me for my appraisal fees (which they must do if the final settlement is higher than the original valuation), Ken went above and beyond to contact the Division of Financial Regulation (aka Insurance Commissioner) on my behalf and advocate for me. He sent me the link to file a complaint which I filed that same day. I told him I was in this fight to win! And sure enough, the insurance company finally did reimburse me.

If you have the time and financial resources to get by while going through the independent appraisal process, I would recommend doing so. The insurance companies are not our friends and we should get what we deserve!

I worked with Ken on the Total of my vehicle, the insurance adjuster wanted to offer me a very low settlement on my truck, that I knew was not right but they would not budge, I ended up hiring Ken. Now was I skeptical yes! The whole thing just didn't feel right to me at first. But Ken assured me that this was going to be a good move, and I was making the right choice. Ken went out of his way to make me feel comfortable in my choice as well, and he was very responsive to all my questions and easy to keep in touch with throughout the whole process.

The whole process took literally a couple weeks after I hired Ken, and this was right in the middle of the holidays. As if those are not stressful enough.

Would I recommend Ken? Absolutely! Everyday all day! If you are honest with him about your vehicle, he will do his best to get you the best outcome possible. He is honest and very open throughout the whole process.

I will say this again and can't stress it enough! Hire an independent appraiser do not let the insurance company take advantage of you ever. You get what you pay for, and his fee is money well spent!

Mike H.

FYI: Follow Kens instructions to the letter. I waited ten days for ken to send me the appraisal, meanwhile, Ken was waiting for me to invoke the appraisal clause with the insurance company and give them his contact information, as I was instructed. Once I did as I was instructed, Ken managed all communications and negotiations with the insurance company, and my claim was settled in four business days. My Bad for not following simple instructions!

Great guy! Great outcome! Highly recommended!

Total Loss Appraisal Clause. Getting Your Real Market Value.

We don’t just write a Total Loss Fair Market Value appraisal like some companies. Our Total Loss auto appraiser will also negotiate with your insurance company’s appraiser to get a fair value for your totaled vehicle. This is included in the price of your appraisal, you won’t be upsold later on like some companies. ALERT! If you pay for an appraisal, and the appraiser charges you an additional amount to negotiate the claim, you may only be reimbursed for the cost of the appraisal only. That’s why we include claim negotiation at no additional charge with all of our total loss appraisals.

Auto Appraiser

Over 14 years as an Oregon Licensed Auto Appraiser #V34-075

Over 30 years of auto appraisal experience.

Negotiator

Ken Nix has over 40 years of negotiation experience, with over 14 years negotiating Oregon Total Loss Claims for Oregonians. We specialize in Oregon Total Loss claims so you don’t have to.

Only Works For Consumers

There’s no conflict of interest here. Unlike some appraisal companies that only claim to work for consumers, we genuinely do. We exclusively represent consumers/policyholders, never insurance companies. – Ken Nix

Detailed Specs

In Oregon and Washington, if you feel you’ve been offered an unfair amount, you’ll normally have an appraisal clause in your policy that allows you to dispute their offer. The appraisal clause allows you to hire an independent auto appraiser to produce an appraisal and your insurance company will also have to hire an independent auto appraiser to produce one for them. The two auto appraisers will negotiate the value between them, if they can not come to an agreement, then an Umpire will decide which appraisal is more credible.

In Oregon, if we increase the value by one cent more than the last offer your insurance company offered you, they have to reimburse you for the cost of the appraisal.

If your claim is with your insurer, you may have the right to an appraisal if your policy

includes an appraisal provision. Your insurer must reimburse your reasonable

appraisal costs if the final appraised value is greater than the insurer’s last offer. This

provision applies to all new policyholders on or after January 1, 2010 and to current

policyholders upon the first renewal of their policy that occurs on or after January 1,

2010. Ask your claims adjuster or the Insurance Division for more information.

Lowball offers from CCC One are more common than you may think. In the case of Buratovich v. Farmers Insurance, documents obtained during discovery, reflected that Farmers Insurance had selected CCC One solely due to it’s evaluations having the lowest payout in regards to a Total Loss Claim. CCC has also recently come under fire in Georgia where consumer advocates claim they have substantially lower valuations than other companies.If your car, truck, RV, motorcycle, or other wheeled vehicle has been totaled, before you accept the insurance company’s total loss offer, you should speak to an Auto Appraiser.

There have also been several Class Action Lawsuits filed regarding Mitchell / J. D. Powers and Associates Total Loss Valuation Methods. This valuation has been involved in several cases where consumers have sought class action lawsuits against State Farm and Progressive for using Mitchell and J.D. Powers valuations.

OREGON CERTIFIED AUTO APPRAISER

OREGON CERTIFIED APPRAISER

When Hiring an Auto Appraiser, make sure they are certified by the Oregon Department of Transportation. Otherwise, the appraisal may not be considered credible. We are an Oregon certified and licensed auto appraiser. #V34-075

CREDIBLE APPRAISALS

Some appraisal companies inflate their valuations in an effort to entice you to use them because they have the largest value. Largest doesn’t mean you’ll settle for more, normally it’s the opposite. Most insurance companies know who provides credible appraisals, and who provide inflated values

AUTOMOTIVE EXPERIENCE

With over 13 years as a licensed and Certified Oregon Auto Appraiser, Ken has the experience to handle any job. He has over 40 years negotiating experience with over 35 years spent in the automotive industry.

You DESERVE A FAIR SETTLEMENT

LEVERAGE

Auto Appraisals

(503) 420-3001

Location

8885 SW Canyon Rd.

Portland, OR. 97225

Open Hours

Mon:10am – 5pm

Tue: 10am – 5pm

Wed: 10am – 5pm

Thur: 10am – 5pm

Fri: 10am – 5pm

Sat: 10am – 5pm

Sun: Closed