Has your car or truck been declared a total loss?

Has your Insurance Company offered you less than what your car is actually worth?

You need LEVERAGE

TOTAL LOSS APPRAISAL

We provide credible total loss appraisals and Expert Negotiation to help you get a fair settlement on your totaled/stolen car or truck.

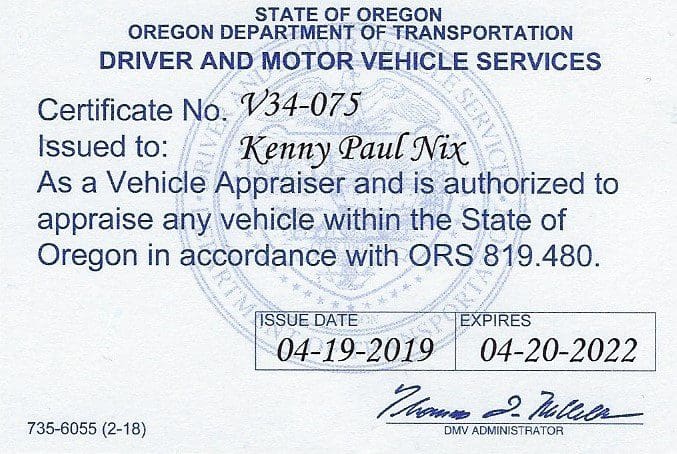

OREGON Certified/Licensed Auto Appraiser # V34-075

Don’t become a statistic for the insurance companies. They want you to just take the pittance they offer you and go away. DON’T DO IT!

Most people don’t realize they have an alternative to agreeing to the lowball valuations produced by companies like CCC ONE or Mitchell/JD Powers.

Did they take $2,000 off of your value for condition, when their comparables had more miles that your vehicle? This is a normal lowball trick.

Did they make an Negotiation adjustment when dealers are not negotiating?

Did they use branded title vehicles, salt state vehicles, or other less desirable vehicles as comparables?

It’s not fair, although it’s legal. As long as they can say their valuation company made the call, not them.

But, you have a choice.

In your full coverage insurance policy, you have what is called an appraisal clause. This is your protection.

LEVERAGE can help you use the appraisal clause to get the money you should be getting for your vehicle. Not, pennies on the dollar.

Total Loss Appraisal Clause. Getting Your Real Market Value.

We don’t just write a Total Loss Fair Market Value appraisal like some companies. Our Total Loss auto appraiser will also negotiate with your insurance company’s appraiser to get a fair value for your totaled vehicle. This is included in the price of your appraisal, you won’t be upsold later on like some companies. ALERT! If you pay for an appraisal, and the appraiser charges you an additional amount to negotiate the claim, you may only be reimbursed for the cost of the appraisal only. That’s why we include claim negotiation at no additional charge with all of our total loss appraisals.

Auto Appraiser

Over 13 years as an Oregon Licensed Auto Appraiser #V34-075

Negotiator

Ken Nix has over 40 years of negotiation experience, with over13 years negotiating Oregon Total Loss Claims for Oregonians. We specialize in Oregon Total Loss claims so you don’t have to.

Only Works For Consumers

No conflict of interest here. While other appraisal companies may claim to work only for consumers, we really do. We only work for consumers, not insurance companies. I’ll state my reputation on that. – Ken Nix

Detailed Specs

In Oregon and Washington, if you feel you’ve been offered an unfair amount, you’ll normally have an appraisal clause in your policy that allows you to dispute their offer. The appraisal clause allows you to hire an independent auto appraiser to produce an appraisal and your insurance company will also have to hire an independent auto appraiser to produce one for them. The two auto appraisers will negotiate the value between them, if they can not come to an agreement, then an Umpire will decide which appraisal is more credible.

In Oregon, if we increase the value by one cent more than the last offer your insurance company offered you, they have to reimburse you for the cost of the appraisal.

If your claim is with your insurer, you may have the right to an appraisal if your policy

includes an appraisal provision. Your insurer must reimburse your reasonable

appraisal costs if the final appraised value is greater than the insurer’s last offer. This

provision applies to all new policyholders on or after January 1, 2010 and to current

policyholders upon the first renewal of their policy that occurs on or after January 1,

2010. Ask your claims adjuster or the Insurance Division for more information.

Lowball offers from CCC One are more common than you may think. In the case of Buratovich v. Farmers Insurance, documents obtained during discovery, reflected that Farmers Insurance had selected CCC One solely due to it’s evaluations having the lowest payout in regards to a Total Loss Claim. CCC has also recently come under fire in Georgia where consumer advocates claim they have substantially lower valuations than other companies.If your car, truck, RV, motorcycle, or other wheeled vehicle has been totaled, before you accept the insurance company’s total loss offer, you should speak to an Auto Appraiser.

There have also been several Class Action Lawsuits filed regarding Mitchell / J. D. Powers and Associates Total Loss Valuation Methods. This valuation has been involved in several cases where consumers have sought class action lawsuits against State Farm and Progressive for using Mitchell and J.D. Powers valuations.

OREGON CERTIFIED AUTO APPRAISER

OREGON CERTIFIED APPRAISER

When Hiring an Auto Appraiser, make sure they are certified by the Oregon Department of Transportation. Otherwise, the appraisal may not be considered credible. We are an Oregon certified and licensed auto appraiser. #V34-075

CREDIBLE APPRAISALS

Some appraisal companies inflate their valuations in an effort to entice you to use them because they have the largest value. Largest doesn’t mean you’ll settle for more, normally it’s the opposite. Most insurance companies know who provides credible appraisals, and who provide inflated values

AUTOMOTIVE EXPERIENCE

With over 13 years as a licensed and Certified Oregon Auto Appraiser, Ken has the experience to handle any job. He has over 40 years negotiating experience with over 35 years spent in the automotive industry.

You DESERVE A FAIR SETTLEMENT

LEVERAGE

Auto Appraisals

(503) 420-3001

Location

8885 SW Canyon Rd.

Portland, OR. 97225

Open Hours

Mon:10am – 5pm

Tue: 10am – 5pm

Wed: 10am – 5pm

Thur: 10am – 5pm

Fri: 10am – 5pm

Sat: 10am – 5pm

Sun: Closed